CSRD: European Companies are One Step Closer to Reporting ESG Impacts, Risks and Opportunities

The European Commission took a giant leap forward toward fulfilling the European Green Deal with its adoption of the European Sustainability Reporting Standards (ESRS) on July 31, 2023. These standards outline not only what sustainability data participating companies will be required to disclose for the Corporate Sustainability Reporting Directive (CSRD), but also how information is to be reported.

Before we take a closer look at who will be impacted by these CSRD reporting standards, let’s look briefly at how we arrived here in the first place.

Before there was CSRD, there was NFRD

2014: The European Commission (EC) adopts Directive 2014/95/EU. This non-financial Reporting Directive (NFRD) requires qualifying companies to include in their annual reports, or separate filings, non-financial statements related to their impact on a number of environmental, social, and governance (ESG) issues including treatment of employees, diversity on company boards, respect for human rights, environmental protection, and social responsibility.

2019: The European Commission endorses the Green Deal, an ambitious strategy to transition Europe to a circular economy to reduce waste and pollution and reach carbon neutrality by 2050. Fostering sustainable economic growth is considered a critical element of the Green Deal’s success, so emphasis is placed on funding economic activities supporting ESG efforts. In order to identify companies that are legitimately supporting ESG efforts, the EC also shares its intention to review the NFRD. According to the EC, in order to appropriately channel funding towards sustainability efforts, stakeholders first need a common framework to evaluate ESG performance.

2020: The EU Taxonomy Regulation comes into effect to address greenwashing. The taxonomy is a complex science-based classification system for identifying activities that can be considered environmentally sustainable. The EU Taxonomy’s definitions and rules enable market participants to identify and invest in sustainable assets with more confidence.

2022: The European Commission adopts the Corporate Sustainability Reporting Directive, which will replace and improve upon the NFRD. Not only does the CSRD mandate more detailed reporting, but it also covers more sustainability matters and applies to more companies. The European Financial Reporting Advisory Group (EFRAG) is tasked with identifying the specific reporting standards needed. Emphasis is placed on developing a set of standards that align with various global standards already in place, such as those from the Task Force on Climate-related Financial Disclosures (TCFD), Task Force on Nature-Related Financial Disclosures (TNFD), the Global Reporting Initiative (GRI) and criteria from the United Nation’s Sustainable Development Goals. The CSRD also includes references to the EU Taxonomy.

2023: After receiving recommendations from EGRAG and hearing public comment, the European Commission issues the European Sustainability Reporting Standards (ESRS). Companies falling under CSRD now have specific disclosure reporting guidelines.

Who will be impacted by ESRS?

While the NFRD affected approximately 12,000 companies, almost 50,000 companies (75 percent of businesses in European Economic Area) fall under the criteria for CSRD.

CSRD initially applies to large public-interest EU companies with over 500 employees, but over several years expands to eventually include small, medium and large EU companies meeting certain financial thresholds. In 2029, companies outside of the EU with subsidiaries or branches in the EU that meet certain thresholds will also be included.

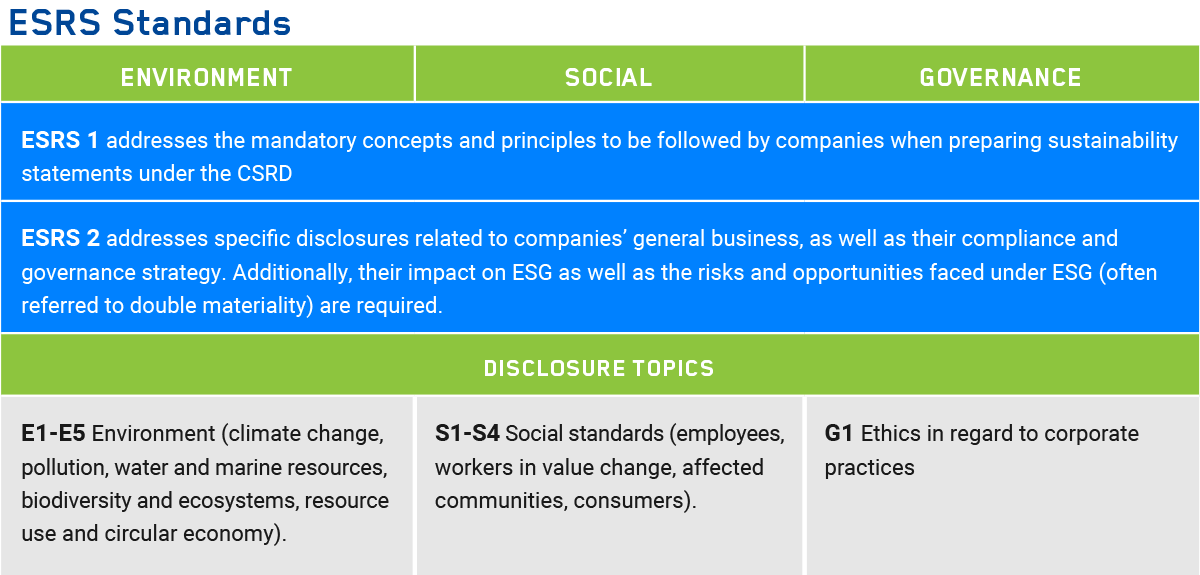

What are the standards outlined in ESRS?

Before looking at the disclosure standards outlined in ESRS, it is important to consider the “why” behind the required disclosures. Ultimately, the European Commission wants stakeholders to clearly understand impacts, risks, and opportunities a company is facing as it relates to ESG issues. This includes both the potential negative and positive impacts an organization has on the community and environment, as well as any sustainability related risks and opportunities faced by the organization.

To make an honest, informed assessment, this requires information related to a company’s governance structure, its internal control and risk management system, as well as its strategy and approach to ESG issues, including policies, procedures, processes, and performance.

If all companies are required to disclose the same information, only then will stakeholders be able to identify those companies that are truly making meaningful and measurable inroads towards the European Green Deal compared to those companies which still have a long way to go.

Christine Adeline, Senior Vice President of Product Management and Product Marketing at SAI360, says CSRD with ESRS is a game changer because it applies to more companies and has own & value chain disclosure requirements and thus comprehensive.

“Not only are you required to report on outcome and performance metrics over time, but ESRS requires you provide information on your strategy, policies, procedures, targets, and action plans as well,” explains Adeline. “This sets the bar high and ensures organizations are doing more than paying lip service to ESG.”

What are important next steps?

CSRD reporting obligations begin in 2025 for large, public-interest companies in the EU with 500 or more employees and a balance sheet total exceeding €20 million or net turnover exceeding €40 million. Since these companies are required to report on 2024 data, that leaves just a few months to identify key deliverables.

Fortunately, many of the companies required to report in 2025 already have a significant number of the standards in place. As mentioned earlier, ESRS incorporates many disclosure requirements from existing standards and frameworks including the GRI, TCFD, TNFD and ISO 26000.

While the ESRS can feel intimidating at first glance, Adeline believes companies with a robust Governance, Risk, Compliance (GRC) implementation will be able to leverage their GRC expertise to operationalize and comply with ESRS requirements more efficiently. Ultimately, CSRD is one more regulatory requirement. It fits well within the GRC framework, which excels at managing risk and ensuring compliance with regulatory requirements.

With that in mind, Adeline suggests the following to get ready for CSRD reporting:

- Thoroughly review and understand the mandatory ESRS reporting standards.

- Understand your business context, align stakeholders, and undertake a double materiality assessment to understand which standards apply to your organization.

- Formulate your Sustainability Strategy to manage sustainability impacts, risks and opportunities and align with your company’s enterprise Risk and Compliance management strategy.

- Identify which elements are already covered as part of your GRC strategy. Incorporate the remaining requirements into your existing GRC strategy.

- Update risks and action plans in addition to policies, procedures to align as needed.

- Identify your targets and performance metrics required from your own operations as well as 3rd parties that form part of your upstream and downstream value chain.

- Develop governance strategy and procedures around the data collection and CSRD report production to ensure compliance with CSRD disclosure reporting and guaranteeing you are prepared for external assurance when it comes into force.

SAI360’s Efforts to Support CSRD

SAI360’s comprehensive ESG software and learning solutions provide the building blocks for a robust ESG compliance and governance strategy. From streamlining data collection to automating tasks and reporting, SAI360 simplifies CSRD compliance, reduces potential for human error, and provides leadership with deep visibility into ESG risks and opportunities across the enterprise.

Here are several examples of SAI360’s ESG capabilities at work:

- Capture CSRD-related impacts, risks, and opportunities centrally and alongside all enterprise risks to ensure sustainability risk management is integrated within overall risk management strategy.

- Track the implementation of actions plans for all types of impacts, risks and opportunities across Environmental, Social and Governance.

- Create, implement, and ensure compliance of all Environmental, Social and Governance policies.

- Embed ESG into corporate culture and extended enterprise by educating employees, board members, and third-party partners on important policies such as working conditions, work-related rights, equal opportunities, child labor, forced labor and other human rights.

- Digitalize and automate the procedures required to meet CSRD disclosure requirements.

- Define metrics and related targets and automate the data collection

- Conduct data analysis to identify trends and patterns to monitor performance over time. Easily identify which actions plans are not working and undertake a targeted review of action plans and policies for optimal results.

- Efficiently support the ESRS reporting by providing data with less effort.

- Conduct assurance assessments to test preparedness and compliance, ensure adherence to standards, and safeguard organization from penalties.

Ultimately, the ESRS is a comprehensive reporting system designed to enhance transparency, accountability, and sustainability practices within companies, providing stakeholders with a better understanding of a company’s performance across ESG domains.

To start a conversation on how SAI360’s comprehensive ESG software and training solutions can support your organization’s CSRD preparation efforts, click here.

Up next: Our next blog takes a deeper dive into SAI360’s capabilities related to the environmental and social standards included in CSRD.