Banking & Financial Services

Banks and financial institutions face increasing regulatory pressure, operational complexity, and scrutiny from global stakeholders. SAI360 helps manage non-financial risk, ensure compliance with standards like Basel III and FFIEC, and strengthen internal controls—within a single, scalable bank GRC software platform.

Integrated compliance and risk management software solutions used by

over 300 Banking and Financial Services organizations across the globe

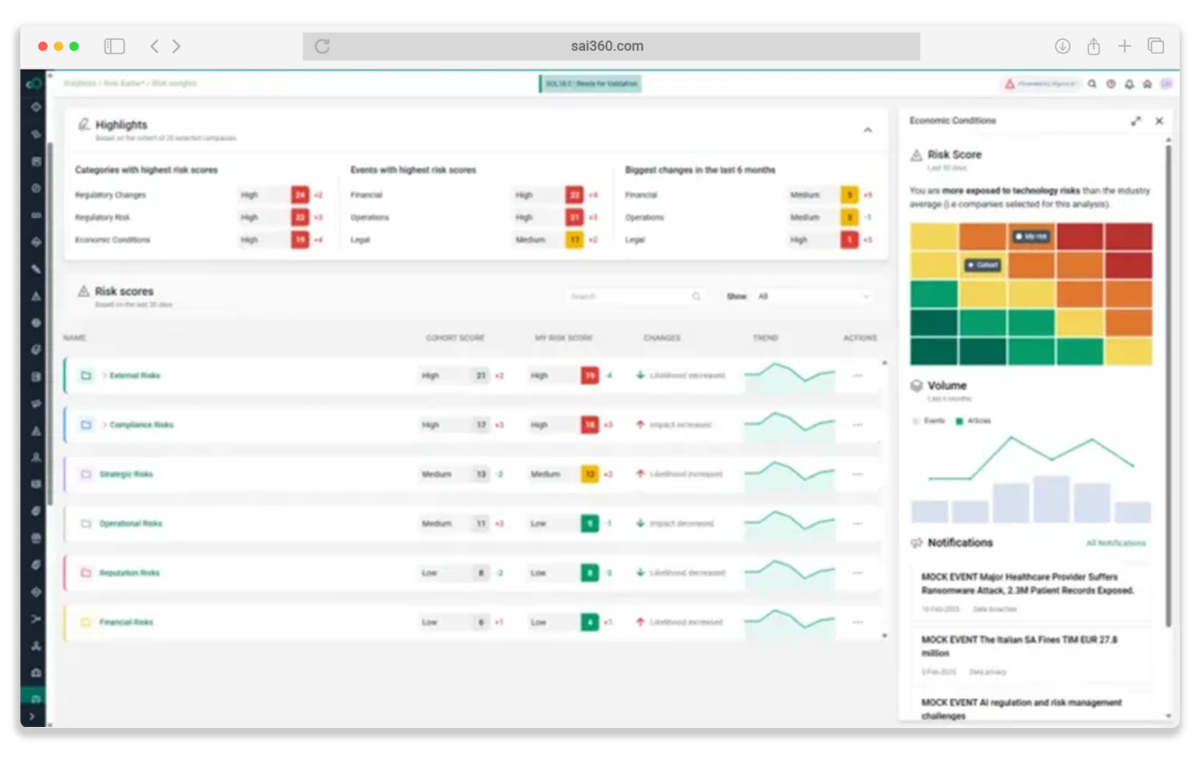

Know Your Risk

Stay ahead of emerging threats and regulatory complexity with data-driven, enterprise-wide risk insights.

- Detect cyber threats, sanction shifts, and third-party risks using AI-driven intelligence

- Track regulatory changes and assess impact across controls, policies, and operations

- Align risk metrics to Basel III and AMA for audit-ready, defensible compliance

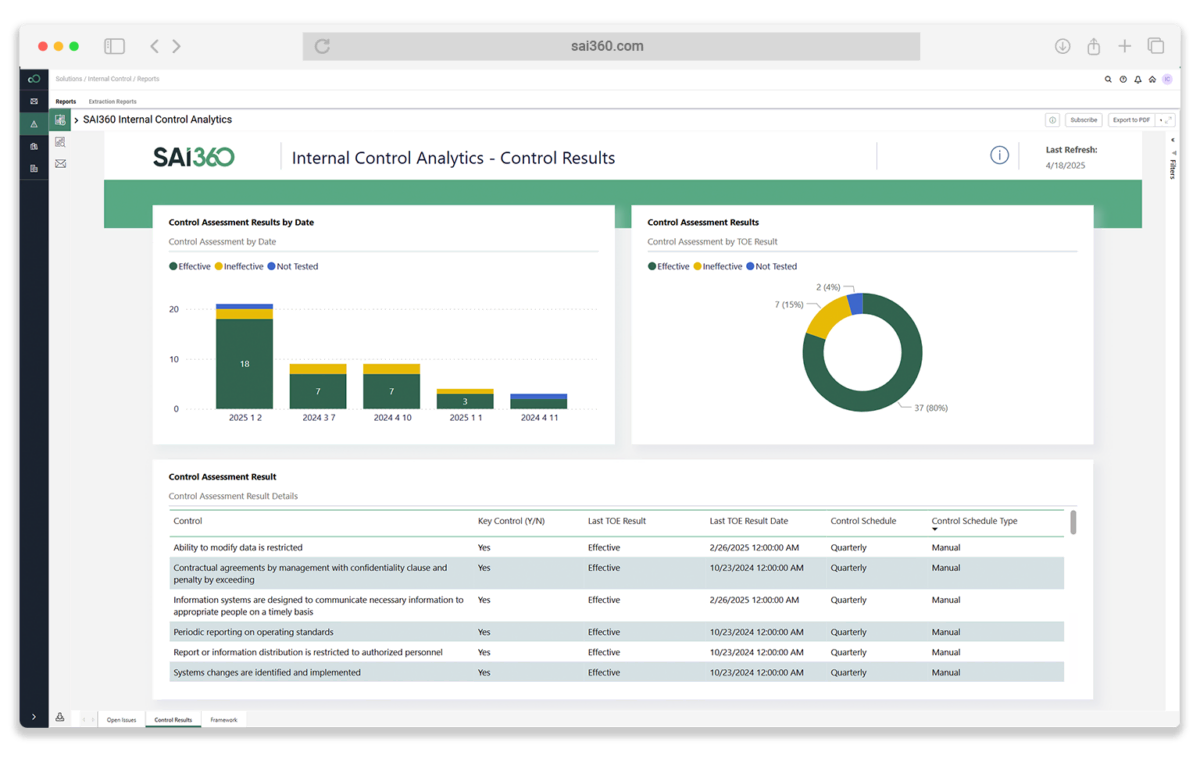

Own Your Controls

Drive efficiency and confidence in controls, audits, and vendor oversight with automation and visibility.

- Automate SOX testing, evidence collection, and audit workflows to reduce manual lift

- Centralize internal controls and customize workflows for seamless internal and external reviews

- Continuously monitor vendors and third parties for regulatory and reputational exposure

“With the help of SAI360, we have been able to implement SOX compliance in less than four months and have also successfully implemented risk management and a control framework.”

– Marleen Lemmens, Robeco

Modules That Power The Solution

Ready to start your risk management program?