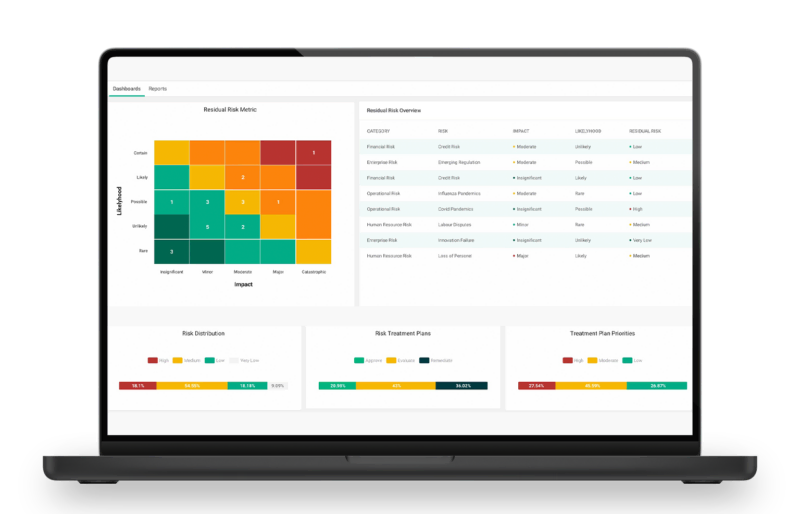

SAI360 helps financial institutions meet APRA CPS230 compliance requirements by centralizing the management of regulatory obligations, risk controls, and incident response. Our software platform connects operational risk, third-party oversight, business continuity, and compliance workflows into a single, integrated solution.

With SAI360, organizations can demonstrate resilience, maintain regulator confidence, and proactively manage the evolving demands of APRA oversight.

Modules That Power The Solution

FAQs

Let Us Help

SAI360 helps you stay ahead of CPS230 with real-time insights to: